Omnichannel marketing is quickly becoming the gold standard.

By incorporating consistent messaging across multiple marketing channels, devices, and touchpoints throughout the sales journey, businesses are elevating the customer experience and enjoying higher retention rates and increased revenue. The challenge, however, comes with understanding which metrics to focus on to ensure your omnichannel marketing strategy is successful.

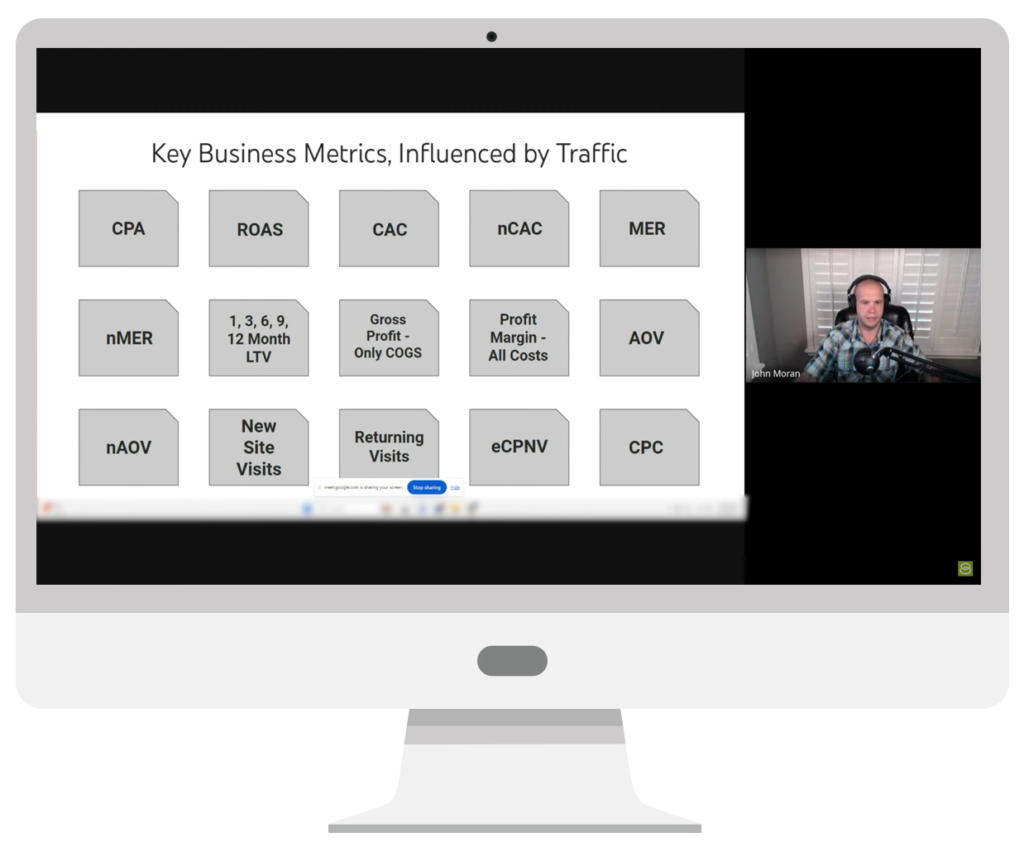

In this short video, Solutions 8 Chief Strategist John Moran explains why he cautions against relying solely on just one or two in-app metrics—and what you should be looking at instead. If you prefer reading to viewing, this blog offers a quick breakdown of what John has to say.

Don't just focus on CPA and ROAS.

John begins by saying that a lot of advertisers, agencies, and business owners typically focus on just two metrics to determine how well their campaigns are performing: cost per acquisition (CPA) and return on ad spend (ROAS).

However, these two metrics are just a small part of a much bigger picture, he explains. To truly understand how your advertising efforts are paying off and determine where you can scale—and whether or not you should scale—John says to look at ALL of the following key business metrics that are influenced by traffic.

- CPA

- ROAS

- CAC (customer acquisition cost)

- nCAC (new customer acquisition cost)

- MER (media efficiency ratio)

- nMER (all revenue from new customers)

- 1, 3, 6 & 12 month LTV (lifetime value)

- Gross profit (only COGS – cost of goods sold)

- Profit margin (all costs)

- AOV (average order value)

- nAOV (new customer average order value)

- New site visits

- Returning visits

- eCPNV (effective cost per new visit)

- CPC (cost per click)

Why do all of these metrics matter?

The answer is because they all have a correlation to one another, and they all work together to provide a holistic view of performance and scalability.

For example, if your eCPNV is too high, it is really difficult to scale. Your CPC could be low, but if you add budget, your eCPNV is where that budget is going to go. CPC is indicative of just a click from a network, while eCPNV is how many of those visitors are new, and a lot of times those are two very different metrics.

John uses the example of a client whose CPC over the last week had been around $3, but in reality they were paying $5 for every new visit. So, when they started to scale back, performance didn’t improve.

“And that’s because they started losing more new visits than returning,” he explained. “So scaling up or scaling down is having the same effect because they’re not actually controlling the difference between CPC and eCPNV. And so when they pull back, everything hurts, so that’s what’s interesting. All these are correlated.”

John also points out that the majority of these numbers are not in-app metrics, which means you need to look beyond what you see in Google or Meta.

The customer journey is highly complex.

According to John, you never want to pull back more new visits than returning visits, because then scaling up or down won’t help. John recommends looking at each metric one by one and determining where to go from there.

And, if you are going to scale up, don’t rely solely on the current performance as it looks in app, because that is only a snapshot in time and what John considers maybe one-fifth of the user journey. So, in terms of traffic, we should be trying to determine if it’s scalable and why or why not.

The glass ceiling of diminishing profitable returns

A little later in the video, John talks about the glass ceiling of diminishing profitable returns, misinterpreted by ROAS. He uses the chart above to illustrate what he means, explaining that we use the word “profitable” because anything that over-attributes, you can scale up and it’s always going to show a good profit return, but it is not affected by the back end.

Meta is often underutilized because, being at the start of the customer journey, it typically has a low return. Google, in contrast, is always overspent because it’s generally the last 30% of the customer journey that we can attribute—which means it’s always going to look good, says John. The key is to identify where that glass ceiling is.

So, when we’re scaling a client, some of the questions we always ask are: What are they doing? What channels are they running? At what levels? What does the customer journey look like? Are we starting a lot of the journey on Meta then overspending on Google and Amazon?

The takeaway

In a nutshell, there are myriad points to consider when looking at omnichannel traffic, and the question is not always “Can we scale?” but “Should we scale?” Always look at what other things the client is doing, and whether or not they are underutilizing any channels.

When thinking about the customer journey, says John, we are essentially in a war for attention with everybody else for a product people want—period. “That’s as simple as this really gets,” he concludes. “That’s why Meta does so well and looks like it does poorly; it wins the war of attention because they have a higher frequency, whereas Google gets like one click.”

Author

Patience is the former director of marketing and communications for Solutions 8. A phenomenal content writer, copywriter, editor, and marketer, she has played a prominent role in helping Solutions 8 become an authority in the Google Ads space. Patience is also the co-author of The Ultimate Guide to Choosing the Best Google Ads Agency and You vs Google.

Patience Hurlburt-Lawton

Patience Hurlburt-Lawton