Read what Nathan Perdriau, Co-Founder and Head of Paid Media at Blue Sense Digital, and Caden Thompson, our Solutions 8 Strategist, have to say about contribution margin and its importance in marketing and business operations.

Table of Contents

What Is Contribution Margin?

Before we tell you what contribution margin is, it would be remiss of us not to mention that its benefits can give you an enormous advantage. Right, so now you know that it’s important to your campaign, let’s get into the nitty-gritty of what it actually is.

Contribution margin is simply a cleaner net margin. It is the difference between what you sell your product for and how much it costs you to make that product. The cost of your product is known as variable cost. In other words, it tells you how much each product sold contributes to paying your fixed costs.

Taking contribution margin further still, it can be divided into three types.

- The first type looks at product costs, otherwise known as gross margin. This is where we take the price of the product minus the cost of the product you buy from the factory.

- The second type looks at the cost of delivery on top of the cost of the product at factory price. Shipping fees, third-party logistics (3PL), and transaction fees should all be deducted from the price of your product.

- Lastly, contribution margin type three is where we take away all of the above from the price of your product plus customer acquisition cost (CAC).

This brings us to the bottom of the profit and loss statement (P&L). From there, we deduct the operating expenses and that leaves you with… net profit.

It is this last one that most eCommerce companies should be tracking on a day-to-day basis. This can be done with some simple software, such as Data Studio, Datapad, Looker, Agency Analytics, and Geckoboard, to name a few.

The key to getting the most out of contribution margin is when you can gain efficiencies at different levels within the business. We’re looking into contribution margin at product level, order level, or time level to get greater insights.

The only question worth asking is: Are we driving incremental profit to the business? What’s the point of having a product that has a $1 or $5 profit margin when CAC is at $30?

Ideally, a list of 30 to 50 products with product titles in an Excel spreadsheet is a fantastic start, along with associated cost of goods sold (COGS). Pull up the basic price export from Shopify or any other platform, and this will give you the gross margin per product.

What does this mean to you, the marketer? It’s a great indication of where you should be allocating budget across campaigns. The contribution margin plays a significant role in campaign creation.

When we consolidate campaign structures, you are generally going to see better performance. There is a stricter allocation of conversion data, which enables better customer modeling.

One of the issues you need to consider is that you give away your control to omnichannel platforms. Segmentation still plays a role in your campaign to a degree, but we are aiming for strategic measures based on contribution margins, and as a result, handing some semblance of control back to the marketing team.

When certain products have a 20% profit and other products have an 80% profit, we shouldn’t be treating them the same. A blanket return on ad spend (ROAS) is not going to work in the same way for different products.

How To Start If You Have Lots Of Products

Now, what do we do when a business has thousands of products? Start with your top-selling products. A Google spreadsheet with a list of top-selling products and their associated gross margins linked to product titles gives you a clear idea of where to focus your efforts.

You are essentially looking for growth opportunities for your client’s business as you develop the campaign structure. Initially looking for big-impact products is the name of the game. And never underestimate the lesser-known products or products that haven’t sold much; they could still be an incredible source of new customers.

On occasion, bypassing big-name products means getting more bang for your buck on lesser-known products because the profit is better. Prioritizing products that are big sellers can often lead to the useless spending of your ad budget.

They might be big-name brands, but if they have terrible gross margins and aren’t driving profit, any company will feel the pinch. A 70% increase in revenue with a profit margin that remains the same, or even worse, goes down, makes absolutely no sense! Volume without profit is like eating soup with a fork. A lot of work with no satisfaction!

We are aiming to have an overall vision of how much contribution profit is being pushed at an individual product level. This is also possible to do at an order level. Take your gross sales minus discounts, COGS, an average three percent transaction fee, and an average three percent shipping and fulfillment fee, which gives you an average based on your typical 90-day data.

To examine the profit contribution at an individual order level, a simple pivot table that sorts the lowest contribution profit shows you some wildly interesting things.

For example, you can compare the spending in Google Ads with excess shipping fees and high COGS on a product that brings in a $1 profit. If you see, for instance, that the CPA is $19, that means you are losing $18 on a product. This is not a profitable order.

Combining products and allowing customers to get a discount is another surefire way to ruin your margins. Free shipping thresholds can also erode margins. What’s the point of fulfilling an order if there’s no contribution profit on it?

All of this gives a business value and helps to identify the inefficiencies within the business and work on them to get the best possible results. It’s not always about ROAS but net profit.

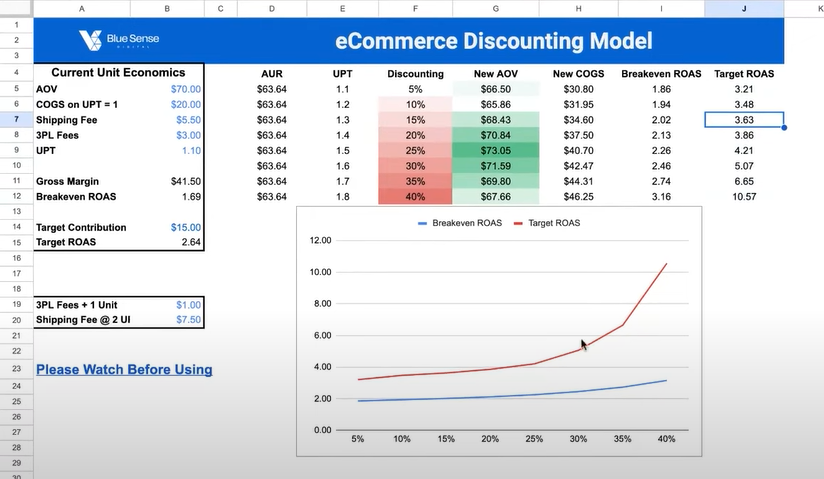

eCommerce Discounting Model

An added benefit of contribution margin is that it will automatically take out discounting. If you’re running discounting, it will appear in the contribution margin that you’re reporting on, on a day-to-day basis.

It’s important to understand that as you increase discounting, let’s say from 5% to 40%, your break-even ROAS goes up significantly. More importantly, if you have a target contribution profit per order, target ROAS goes up exponentially.

You may think a discount of 20% requires a small increase in ROAS but you will find you actually need to double your ROAS. You’ve cut your profit, which was at the top end, in half if you were operating on a 30% gross margin.

As you escalate your discounting, you need your units per transaction to increase. The average order value will simultaneously need to increase as well. You cannot be discounting and expect a higher ROAS to drive more profit. It won’t! Start with a small discount and see who bites. Take them out of the equation, and then go to the next process and see how far you can push it until you hit that point of diminishing returns.

And what is the relationship between contribution margin and lifetime value (LTV)?

Remember the importance of first-order profitability? Well, when it comes to LTV there is time decay associated with it. Are we looking at LTV on a 30-day time frame, a 90-day LTV, or a lifetime LTV (since the inception of the company)?

The risk factor increases, as does the cost of capital the further out we go. Acquiring new customers in the hope of unlocking profits over a very long period usually means there’s a huge cost of capital involved.

A secondary factor to consider is that it is revenue based. It tells you how much revenue you’re getting from a customer over its lifetime. If you look at the unit economics of any brand, and if you break down first-time versus returning customers, those returning customers are often getting a 30% discount.

Why is that? More than likely, the brand is sending off emails with 20% codes, 30% codes, or 40% codes to try to get people back. The profit contribution of these customers is very minimal. In addition, most advertisers are spending 20% of their budget on existing clients and they don’t even know it.

A simple breakdown: Take a $100 average order value with an LTV of $200, and it appears we’ve doubled the profitability of the customer. Picture a 30% discount, which leaves us with $160 to $170 in revenue. There could be a $10 CAC. That now changes everything. Returning customers that don’t drive profit are just as useless.

We shouldn’t be scaling acquisitions. We should be fixing acquisitions first and then focusing on retention strategy without relying so heavily on discounting. You can increase the volume of new customers when you realize LTV eats into net profit. Make sure you are tracking the contribution margin across a lifetime of customers.

And that’s it. We hope you have enjoyed our insights into contribution margin. If you’re looking to learn more, tune into Solutions 8 and get in touch with our experts!

Tim Lyons

Founder || ProFit Marketing Solutions

Two-time “Two Comma Club Award” Recipient

Interested to work with us?

No cost. No obligation. No high-pressure salesmanship. The action plan is yours to keep regardless of whether or not you choose to move forward with us. What do you have to lose?

Author

Patience is the former director of marketing and communications for Solutions 8. A phenomenal content writer, copywriter, editor, and marketer, she has played a prominent role in helping Solutions 8 become an authority in the Google Ads space. Patience is also the co-author of The Ultimate Guide to Choosing the Best Google Ads Agency and You vs Google.

Patience Hurlburt-Lawton

Patience Hurlburt-Lawton